Practical Money Solutions To Every Veteran’s Common Financial Problems

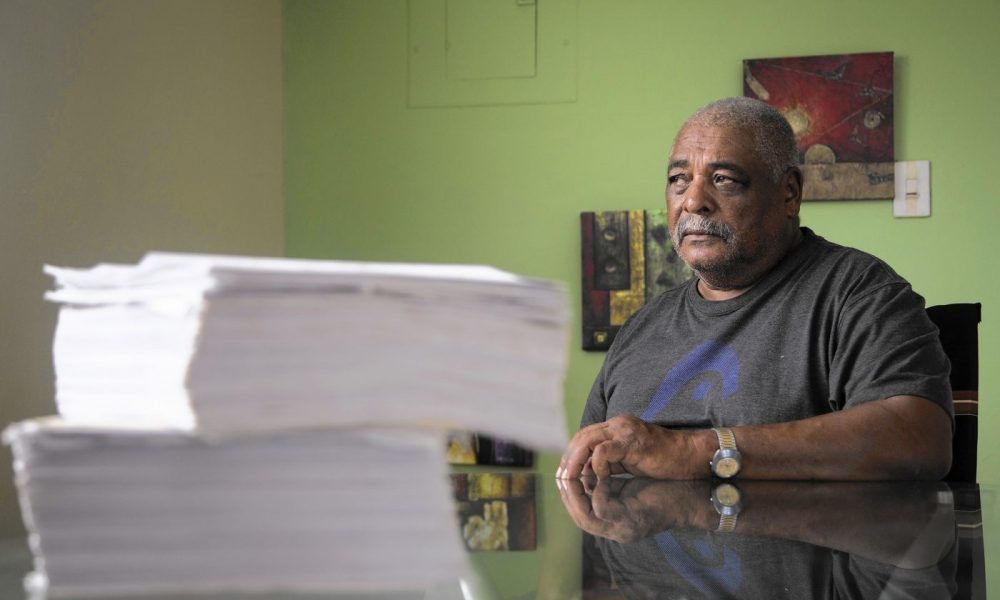

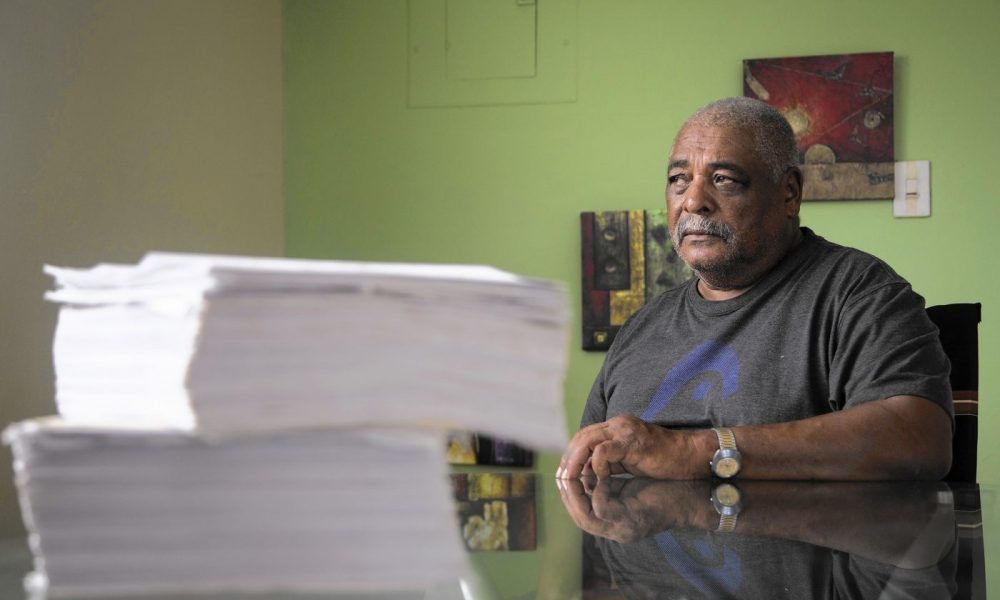

Going back to life as a civilian after military service has its fair share of emotional issues, but that doesn’t mean that the practical parts aren’t just as hard. One still needs to find a job, somewhere to live and paying for everything that comes with that. Considering that many vets sign up for service when they’re still young, their financial management skills are often lacking. Issues like homeownership and handling debt are usually out of the military mindset, where one has such needs covered. So, perhaps some tips and advice on getting to grips with civilians finances might be in order.

Stay away from loan sharks and don’t fall into debts.

A number of proposals have been suggested by the Department of Defense to help veterans avoid predatory lenders. Considering the higher risk veterans run of facing financial difficulties, the D.o.D.’s advice is more than welcome.

When members of the military rejoin civilian life, they have an increased chance of facing money problems, compared to others. This situation is something loan sharks are keen to exploit, which is why the D.o.D. is seeking to make regulations on the issue more robust. One such rule, for instance, is the provision that 36% is the highest percentage rate per year on consumer credit that can be charged. The only types of loans that used to fall under this rule were vehicle title, payday and tax refund anticipation.

Create a transition fund.

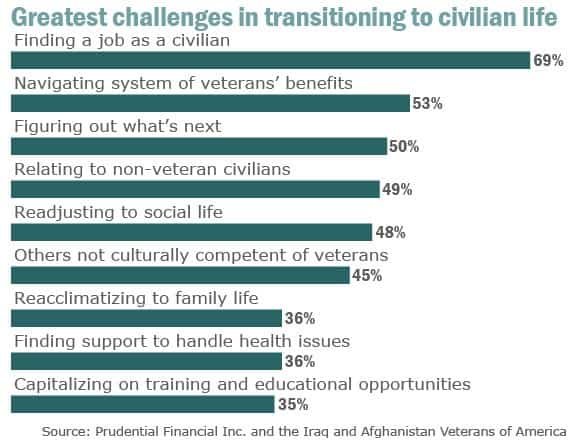

As shown by the survey data above, just one-third of veterans went through a smooth reintegration into civilian life and almost half of them were not ready to do so, emotionally. The main causes of these problems seem to be various health issues they face and high unemployment rates.

Unsurprisingly, a lot of those health issues are directly related to their service, which leads many among them to want to relax and think things through before making any important decisions after their time in the army is over.

According to a financial advisor, many in the military, grown complacent by the regularity and stability of their income, fail to maintain a cash cushion for an emergency. Unfortunately, when their service ends, many take more time to find a job than one would expect. Therefore, a decent “cushion” should be enough to live on for nine months. A good start would be to save 10% of one’s salary in a savings account or a fund. A homeowner can also apply for a home-equity line of credit, a decent emergency cash flow which can be easier to secure while still in the armed forces.

The bottom line is to be prepared, both you and your loved ones, to overcome some difficulties in transitioning from deployment to civilian life.

More inOpen Your Mind

-

`

What to Expect From Qatar Airways Business Class

Qatar Airways business class offers a luxurious experience for those seeking a comfortable and stylish flight. Travelers can expect a journey...

September 25, 2024 -

`

How to Deal with Gaslighting: 6 Effective Ways

Gaslighting is a manipulative tactic used to make a person doubt their own reality, memories, or perceptions. It can occur in...

September 21, 2024 -

`

Top 5 Things to Do in the Big Apple

New York City, often hailed as the “City That Never Sleeps,” offers an endless array of experiences. From towering skyscrapers to...

September 11, 2024 -

`

Easy-to-Follow Steps to Make Pappardelle Pasta at Home

Making pappardelle pasta at home is a rewarding culinary experience that brings the taste of Italy into your kitchen. Pappardelle, a...

September 5, 2024 -

`

How Legally Binding Is a Lease?

How legally binding is a lease? Understanding how legally binding a lease is becomes crucial for landlords when considering rental agreements....

August 31, 2024 -

`

Top 5 Must-Try Dunkin’ Donuts Breakfast Foods

When you are on the go and need a quick yet satisfying breakfast, Dunkin’ Donuts is a favorite stop for many....

August 21, 2024 -

`

What Are the Top 6 Best Places to Raise Children in the U.S?

Choosing where to settle down and raise a family is one of the most significant decisions parents can make. Finding the...

August 17, 2024 -

`

Is Wearing a Hoodie a Sign of Depression?

Is wearing a hoodie a sign of depression? This question has crossed the minds of many concerned parents and friends. It...

August 9, 2024 -

`

Top 6 Things You Should Consider Buying When You Are in Japan

Traditional Japanese Tea Sets When thinking about what to buy in Japan, traditional Japanese tea sets top the list. These beautifully...

July 31, 2024

You must be logged in to post a comment Login