Try These Money-Saving Hacks For Military Families

More and more military families are now vigilant with regard to managing their finances. Taking it from the previous experiences of their mentors and fellows, you surely wish to make your investments work for you and save more for your future.

The following simple money-saving tips aren’t just for military families but also for civilian folks. With that, we truly hope that these budgeting hacks can help your close ones spend less, whether this is about short-term expenses or lifetime investments. Monitoring your expenses will help you eventually retire with much more cash than you would probably expect, so take a good look at those tips below!

Always be patient to monitor your expenses.

You’ve surely heard people complaining about not knowing where they spend their money. Before they know it, they’re left with no cash, and this is something that can happen to all of us. However, if you keep track of what you buy and where you spend your bucks, then it’s much easier to plan your financial moves in the future. This can be achieved with many different tools: many people tend to write their expenses down, while nowadays, there are also many mobile applications which can help you monitor your expenses.

You’ve surely heard people complaining about not knowing where they spend their money. Before they know it, they’re left with no cash, and this is something that can happen to all of us. However, if you keep track of what you buy and where you spend your bucks, then it’s much easier to plan your financial moves in the future. This can be achieved with many different tools: many people tend to write their expenses down, while nowadays, there are also many mobile applications which can help you monitor your expenses.

Create habits with automatic deductions.

Dealing with personal finance requires much discipline. Make it easier on yourself through automatic deductions. To really get your savings and emergency funds going, set up separate accounts outside of your main checking account. Through this option, you get to have no choice but to allot a portion of your salary or income to those funds. Brilliant!

Pay In Cash Only.

You surely know someone who got into some serious trouble for using his credit card too much. We would advise you to skip paying with cards and use cash only, as you’ll know exactly what you spend, and you won’t be tempted to buy more unnecessary stuff, even if you can’t afford it at the time. Keeping a card in case an emergency happens is not a bad idea, but be sure to use it just for that purpose.

Pay yourself first.

Many people believe that it’s better to pay your bills and expenses and then put everything that’s left straight to their savings account. That’s not a bad idea, but, on the road to budgeting, there’s something better you can do.

Many people believe that it’s better to pay your bills and expenses and then put everything that’s left straight to their savings account. That’s not a bad idea, but, on the road to budgeting, there’s something better you can do.

Instead of relying on your financial leftovers to increase your savings, you can put all you’ve got in your savings account first and then pay for your monthly expenses. This will help you monitor what’s left in your account, and it will encourage you to increase your savings, a financial sum which is very important in life.

Very Simple Budgeting Tips That Can Help You Save Thousands

Don’t Skip Cooking

Today’s stressful way of life leaves you with almost no time to cook and prepare proper meals, but, believe us, eating fast food is going to hurt your wallet significantly. Take some time to prepare your meals at home, and this is something that you can even do in the weekend. It will save you from a lot of unnecessary spending.

Learn to always unplug appliances.

This doesn’t only prevent household fires but also lets you to save even more. So make it a habit to unplug anything you aren’t using frequently to avoid phantom energy use. Find other ways and utilize every energy use tweaks that you can find. Remember that being more conscious about your household appliances as well as your overall energy use, is a great way to help the environment and at the same time aid in boosting your finances.

This doesn’t only prevent household fires but also lets you to save even more. So make it a habit to unplug anything you aren’t using frequently to avoid phantom energy use. Find other ways and utilize every energy use tweaks that you can find. Remember that being more conscious about your household appliances as well as your overall energy use, is a great way to help the environment and at the same time aid in boosting your finances.

Invest in high-quality items; they’ll definitely last longer!

It’s safe to say that, when you have your own place, you’re going to spend a lot of cash on home appliances. While this article offers you budget tips, purchasing budget home appliances isn’t the best you can do. In this occasion, investing in items which cost more is a much better option. Not only do they consume less electricity and lower your monthly bills, but they also last longer and come with better quality specs.

Of course, this requires that you do some research before buying a new home appliance. It is definitely worth your time and it will save you from unwanted expenses and functioning problems in the future.

Spending Doesn’t Diminish Your Stress

Many a time, you come home from a tough day at work, and you decide to do some online shopping, as you feel that this will eliminate your stress and exhaustion and it will make you feel better. However, it practically rarely helps. Find other ways to relax and don’t put another financial burden in your mind that might eventually cost in the future.

Stop Keeping Unnecessary Stuff

A wise idea would be to go around your house and check out the things you have in there. You’ll quickly realize that you don’t need all of those items you’ve gathered in your place. We often tend to keep items which are totally useless for us, while if we got rid of them, they would probably become useful for others who might use them in a different way. Moreover, you’ll manage to clean your house as you go through the process of throwing stuff away, and a clean and spacious house is always more valuable!

More inLifestyle

-

`

A Veteran’s Open Letter To The Prince Of Cambridge

If you were born a prince, like a famous Prince of Cambridge, you would have a lot of options for your...

June 5, 2023 -

`

You Must Appreciate the Amazing Growth of the Tulsa Community Foundation

The Tulsa Community Foundation (TCF) is a charitable organization which was founded on the 30th of December 1998 by a banker,...

June 5, 2023 -

`

ELDERBERRIES: Learn about These Powerful, Immune-Strengthening Tart Little Fruits!

What would you do if someone handed you a capsule that could regulate your blood sugar level, help you lose weight,...

June 5, 2023 -

`

Here Is Why Lucy Kennedy Should Be Your Inspiration

For normal people like us, celebrities (or famous people, for that matter) offer a window to the limitless possibilities which we...

June 5, 2023 -

`

If You’re Among The Health-Watchers, You Should Probably Know About Pre-Diabetes

If you’re an adult and consider yourself sufficiently aware, you know what diabetes is. The disease is so common that even...

June 2, 2023 -

`

Motivation Isn’t Enough to Get You to the Finish Line; You Need Discipline!

Motivation is the intrinsic spirit to undertake a challenging task. It is the positive enforcement that comes from within and keeps...

June 2, 2023 -

`

Gardening and Green Activities: a Definite Solution for Your Anxiety Attacks!

If you are not fond of nature and nurturing plants, you may be shaking your head at the idea of gardening....

May 30, 2023 -

`

Health Benefits Of Eating Beets You Probably Didn’t Know

Beets have gained much importance as a healthy low-calorie food option in many diet charts. It has become one of the...

May 30, 2023 -

`

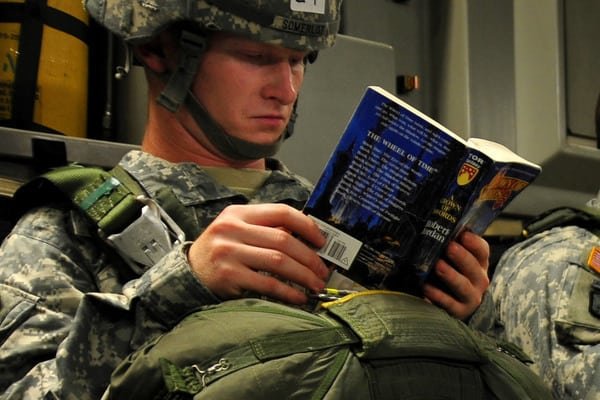

Best Books Ever Written About War That Every Man Should Read

Every military service member needs his daily dose of knowledge and skill enhancement, inspiration and motivation. And reading some books about...

May 30, 2023

You must be logged in to post a comment Login